Background

The Morningstar RatingTM for funds, often called the “star rating”, debuted in 1985 and was quickly embraced by investors and advisors.

Using an easily-identifiable scale from one to five stars, Morningstar Ratings™ have helped investors and their advisors make more fully-informed decisions about fund managers and their funds, and build and manage better investment portfolios.

What It Means for Investors

The Morningstar RatingTM is a quantitative assessment of a fund’s past performance—both return and risk—as measured from one to five stars. It uses focused comparison groups to better measure fund manager skill. As always, the Morningstar RatingTM is intended for use as the first step in the fund evaluation process. A high rating alone is not a sufficient basis for investment decisions.

Morningstar Risk-Adjusted Return

The Morningstar RatingTM is based on a fund’s Morningstar Risk-Adjusted Return (‘MRAR’) measure, the foundation of our global quantitative research since 2002.

MRAR is motivated by ‘expected utility’ theory, whereby an investor ranks alternative portfolios using the mathematical expectation of a function (called the ‘utility’ function) of the end value of each portfolio. With this basis in expected utility theory, investors are firstly, more concerned about a possible poor outcome than an unexpectedly good outcome; and secondly, willing to give up some portion of their expected return in exchange for greater certainty of return. The rating accounts for all variations in a fund’s monthly performance, with more emphasis on downward variations. It rewards consistent performance and reduces the possibility of strong short-term performance masking the inherent risk of a fund.

Morningstar Categories

A fund’s Morningstar RatingTM is relative to the MRAR measures of other funds in the same peer group. This makes it even more important that peer groups are constructed appropriately.

Morningstar Categories are therefore built to create well-defined groups, in which constituent funds can be considered direct alternatives. These Morningstar Categories are based on our global Style Box model, which classifies funds according to the market-cap and investment style of the securities in which funds invest.

Grouping similar-style funds together in discrete Morningstar Categories ensures investment styles are treated equally, and helps investors and advisors select and combine funds in ways more likely to translate into true portfolio diversification.

Multiple Share Classes

Although different share classes of a fund share the same portfolio, each share class is evaluated separately because their individual expense structures produce different returns. For the rating distribution scale, however, a single portfolio counts only once, regardless of the total number of share classes. This prevents a single portfolio from dominating any portion of the rating scale.

How Does It Work?

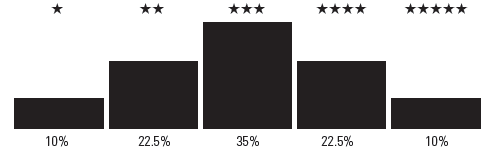

Funds are ranked by their Morningstar Risk-Adjusted Return scores and stars are assigned using the following scale:

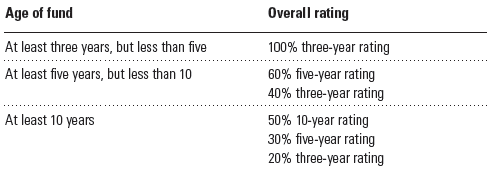

Funds are rated for up to three periods—the trailing three-, five-, and 10-years. For a fund that does not change categories during the evaluation period, the overall rating is calculated using the following weights:

These mixes reward consistent good performance over an extended timeframe, and are less subject to short-term variations in fund performance.

Qualitative Research

While Morningstar Ratings are solely quantitative measures, our commitment to forward-looking qualitative research remains, as we believe this is critical to helping investors and advisors make informed decisions about fund managers’ capabilities.

The separation of qualitative research – in the form of the Morningstar Analyst Rating – from quantitative research – the Morningstar Rating – reduces complexity, and introduces greater transparency into the intellectual property Morningstar provides for assessing past performance and future prospects.

The Morningstar Analyst Rating – from ‘Gold’ to ‘Negative’ – provides a clear and actionable distillation of our fund analysts’ views about an investment strategy.

The accompanying report and commentaries focus on key issues and risks, while extensive, regularly-updated holdings, valuation multiples, and performance data offer meaningful insights into current and future performance drivers and outcomes. Readers will understand how a fund manager’s philosophy and process translate into security selection, and whether or not the fund manager is staying true to label.

Investor Benefits

- Is sensitive to manager skill and fund quality and less sensitive to recent overall performance of the category

- Gives investors the ability to quickly and easily identify funds that are worthy of further research, those with superior risk-adjusted returns

- Separation of quantitative research (Morningstar Rating) from qualitative research (Morningstar Analyst Rating) reduces complexity and introduces greater transparency to fund assessment.

For the full Morningstar Rating methodology, please click here.