For many investors, the thought of investing in companies from emerging markets may provoke a sense of unease. Names like Infosys (INFY), and OAO Gazprom (OGZD) aren't exactly household names here. Yet many investors already own emerging-markets companies like these through their mutual funds and exchange-traded funds without even realizing it.

Among the most difficult aspects of investing in emerging markets is that it forces us to do something that runs counter to a cardinal rule of investing. One of the first pieces of advice many investors are given--and the wisdom dispensed by luminaries such as Warren Buffett and Peter Lynch--is to invest in what they know and to avoid investments they don't understand. Yet when it comes to emerging markets, investors often know little about the companies themselves or the national and regional economies in which they operate. In a sense, these stocks represent a blind spot for many investors, yet they are too important to be dismissed outright and offer performance and portfolio diversification advantages that can't be ignored.

Before we look at the pros and cons of investing in emerging markets, we better clarify what we mean by the term. In general, emerging markets are still developing--that is, they have more room to grow than more developed markets such as the U.S., Western Europe, and Japan. Emerging markets include large countries such as China, India, and Brazil as well as smaller ones such as Poland, Chile, and the Philippines. Below is a look at what investors can expect from their emerging-markets holdings in terms of risk/reward and diversification potential.

Performance: Better Fasten Your Seat Belt

For a quick lesson in the volatility potential of emerging-markets stocks, look no further than their performance during the 2008 financial crisis. That year the MSCI Emerging Markets Index, which tracks 21 emerging economies worldwide, lost more than half its value--53.3%, to be exact--only to rebound the following year with a whiplash-inducing 78.5% gain. By comparison, the S&P 500, a widely used proxy for the U.S. stock market, lost 37.0% and gained 26.5% those same years.

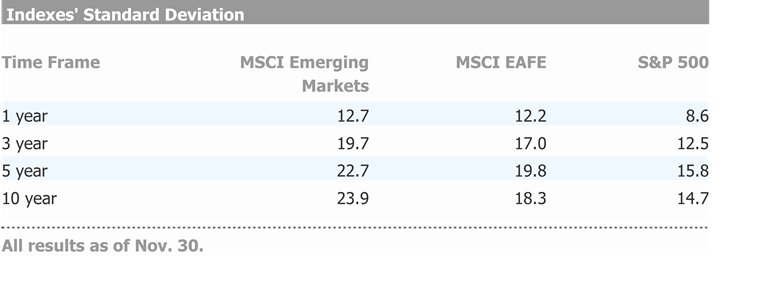

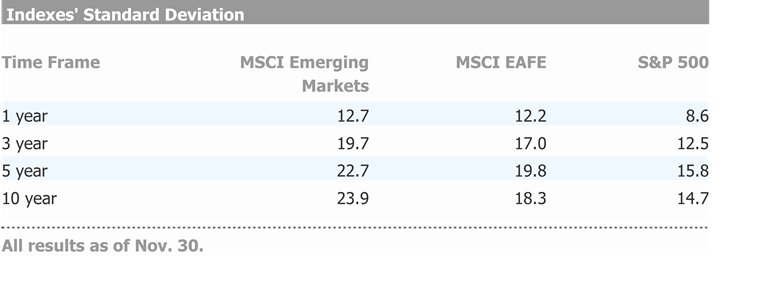

One way to compare the volatility level of emerging-markets equities with those in developed markets is by looking at standard deviation statistics, which measure the extent to which performance varies to the upside or downside. Below is a table that shows the standard deviation for three indexes: the MSCI Emerging Markets Index, the MSCI EAFE Index (which tracks the performance of 21 developed markets outside North America), and the S&P 500.

As you can see, the emerging-markets index experienced greater volatility across all time frames than the other indexes, followed by the MSCI EAFE and the S&P 500. Focusing on the 10-year volatility statistics, one can clearly see the degree to which emerging-markets stocks travel a much bumpier road than U.S. large-cap equities.

Emerging-markets equities tend to be more volatile than stocks in more developed markets because of a variety of risk factors. These can include uncertain regulatory environments, currency fluctuations relative to the dollar, and volatility in commodity prices, which affects countries with economies based on natural-resources production. Those risk factors, and the accompanying volatility, is a key reason financial pros recommend that emerging markets play a supporting role rather than a dominant one in investors' portfolios. Most would have a tough time owning a portfolio with such dramatic gyrations.

So why not steer clear of emerging markets altogether and save ourselves the aggravation? Our next table shows why.

If it seems like you haven't heard much about emerging-markets stocks lately, one look at the index's one- and three-year annualized returns should explain it. Their performance has lagged that of the U.S. and other developed markets badly during that time. But the five- and 10-year returns tell a different story. In fact, during the past decade emerging-markets stocks have returned 12.1% per year on average while U.S. and other developed-markets stocks have returned about 7.6% annually. This outperformance by emerging markets during the long term helps explain why they are so compelling for equity investors with long time horizons. Their higher return potential makes them a great source to juice a portfolio's overall performance, provided that the investor can wait long enough to offset their high volatility.

Diversification: Spreading Your Bets

Another point in favor of emerging markets is their role in diversifying a portfolio. Just as emerging-markets stocks may lag when U.S. stocks are humming along, so, too, can the opposite occur. In fact, from 2003 to '07 the MSCI Emerging Markets Index outperformed the S&P 500 by an average of about 24 percentage points per year. Investors who shied away from such stocks during that time missed out on some of the decade's biggest gains.

One way to measure the diversifying properties of emerging-markets stocks is by measuring their correlation to other markets, which measures the degree to which they move in sync. During the past decade, emerging-markets stocks and U.S. stocks have had a correlation of 0.79 (with 1 meaning they move in full lockstep and 0 meaning they don't move together at all). By comparison, U.S. stocks and those from other developed nations have had a correlation of 0.89 during that time frame while U.S. stocks and investment-grade U.S. bonds have had a correlation of 0.05. However, there are times when these equity correlations are much lower. For example, during the past year, in which U.S. stocks have been on a tear while stocks in emerging markets have languished, correlation between the two has been just 0.46.

Choosing Good Investment Vehicles a Must

Because of many U.S. investors' lack of familiarity with numerous emerging-markets companies, choosing quality mutual funds and ETFs led by capable managers or good fund shops is as essential here as in any area of the market. A good fund will have an experienced and knowledgeable research team with a deep understanding of the companies and markets in which they operate. Emerging-markets index funds, such as the Silver analyst-rated Vanguard Emerging Markets Stock Index (VEIEX), also are available and provide emerging-markets exposure for investors who prefer passive management. Investors may also choose to obtain emerging-markets exposure via a broadly diversified foreign-stock fund. A total market index tracker like Vanguard Total International Stock Market Index (VGTSX) would provide ample exposure to emerging markets, as would some active funds, such the Gold-rated Dodge & Cox International Stock (DODFX).

Whichever approach you prefer, the point is to go with investment vehicles run by pros who know how to navigate this very tricky segment of the market. You wouldn't travel to another country without doing your research and making sure you will be in good hands. You probably shouldn't invest that way either.