All figures are quoted in MYR unless otherwise stated.

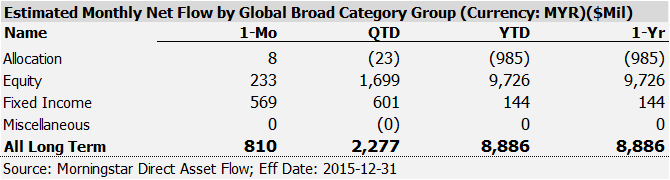

Fixed income funds attracted most inflows in December

Fixed income funds recorded 569 million inflows in December, making up the outflows earlier in the year, the category gained 144 million inflows in the whole 2015. Equity funds attracted almost 9,726 million inflows in 2015.

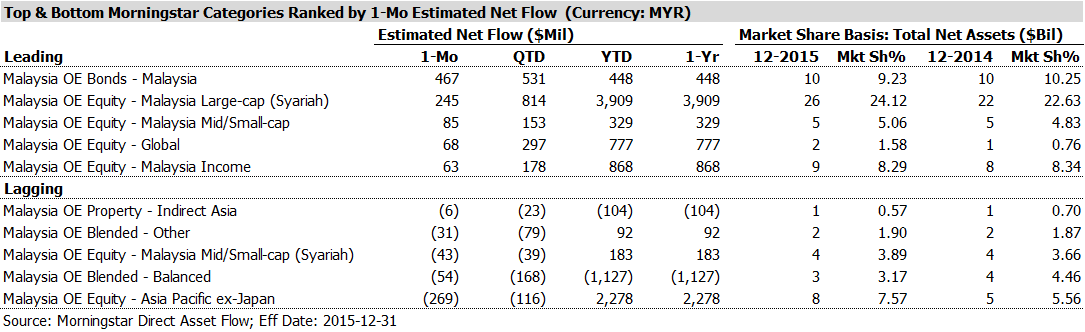

Flows by Morningstar Categories

(Ranked by 1-Mo flow as of December 2015, excluding money markets and funds of funds)

Bonds – Malaysia funds attracted most inflows among all Morningstar categories in Decemebr, recorded an estimated amount of 467 million. Asia Pacific ex-Japan funds suffered significant outflow in the month.

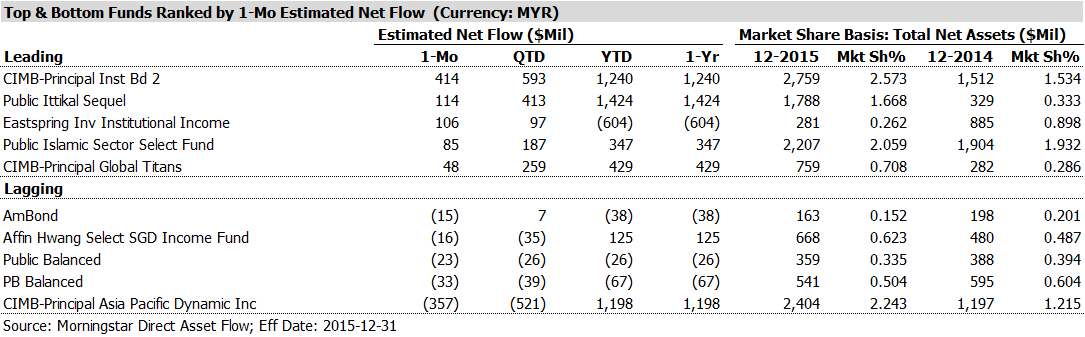

Top- and Bottom- Flowing Mutual Funds

(Ranked by 1-Mo flow as of December 2015, excluding money markets and funds of funds)

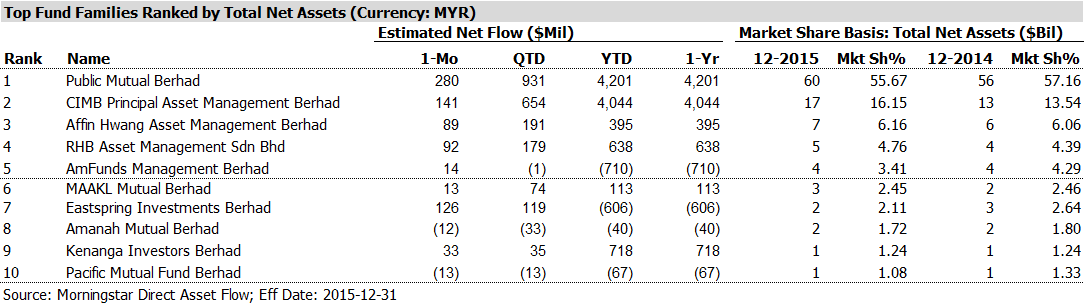

Flows by Fund Family

(Ranked by assets as of December 2015, excluding money markets and funds of funds)

The largest fund family by AUM in Malaysia, Public Mutual, saw 280 million net inflows in December, putting its 2015 inflow to 4.20 billion. CIMB Principal Asset Management has also attracted huge net inflows this year, an estimated amount of 4.04 billion.

Important methodology note: Morningstar computes flows using the approach that is standard in the industry: Estimated net flow is the change in assets not explained by the performance of the fund. Our method assumes that flows occur uniformly over the course of the month. Adjustments for mergers are performed automatically. When liquidated funds are included, the final assets of the fund are counted as outflows. Reinvested dividends are not counted as inflows. We use fund-level reinvestment rates to improve accuracy in this respect. We make ad hoc adjustments for unusual corporate actions such as reverse share splits, and we overwrite our estimates with actual flows if managers are willing to provide the data to us. Please click here for a full explanation of our methodology.