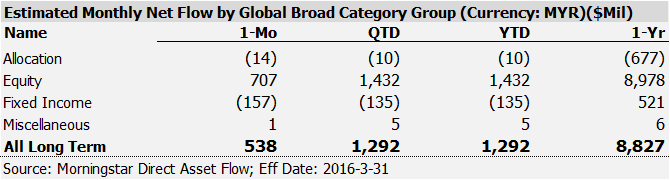

All figures are quoted in MYR unless otherwise stated.

Equity funds attracted most inflows in March

Equity funds recorded 707 million inflows in March, putting its QTD inflows to 1.43 billion.

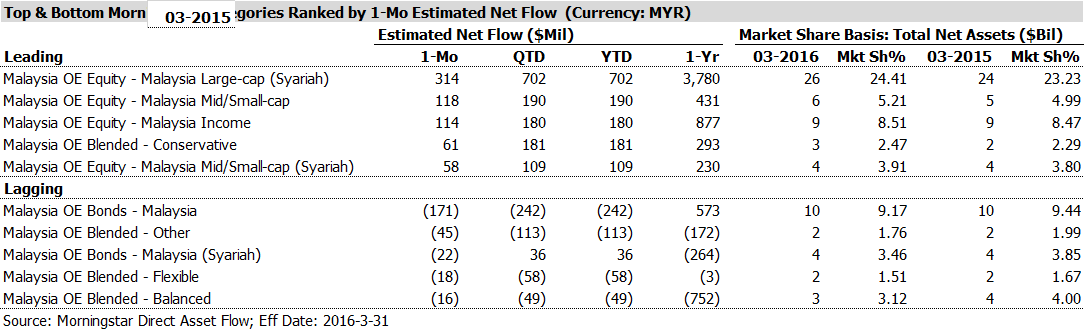

Flows by Morningstar Categories

(Ranked by 1-Mo flow as of March 2016, excluding money markets and funds of funds)

Equity – Malaysia Large-cap (Syariah) funds attracted most inflows among all Morningstar categories in March, recorded an estimated amount of 314 million. Bonds – Malaysia funds suffered significant outflow in the month.

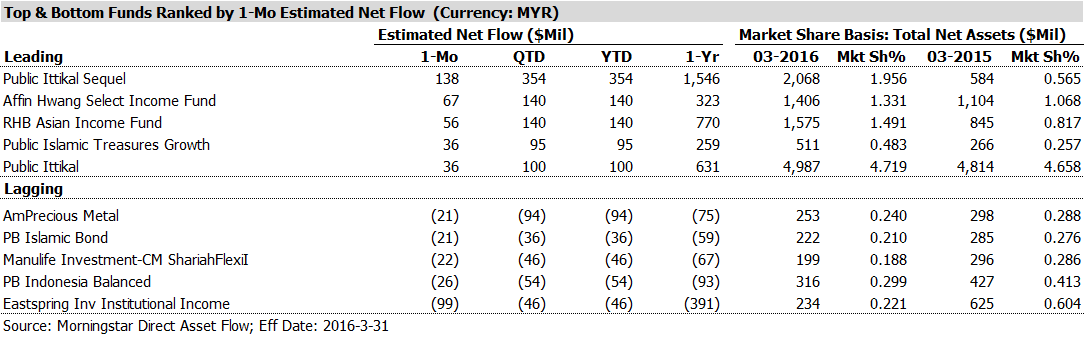

Top- and Bottom- Flowing Mutual Funds

(Ranked by 1-Mo flow as of March 2016, excluding money markets and funds of funds)

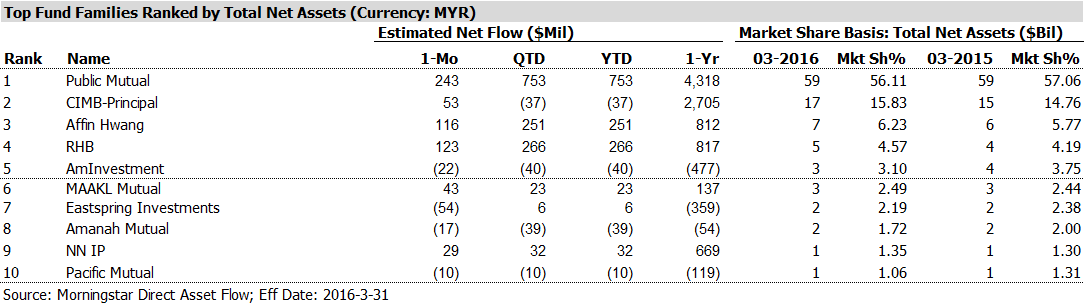

Flows by Fund Family

(Ranked by assets as of March 2016, excluding money markets and funds of funds)

The largest fund family by AUM in Malaysia, Public Mutual, saw 243 million net inflows in March, putting its Quarter inflow to 753 million.

Important methodology note: Morningstar computes flows using the approach that is standard in the industry: Estimated net flow is the change in assets not explained by the performance of the fund. Our method assumes that flows occur uniformly over the course of the month. Adjustments for mergers are performed automatically. When liquidated funds are included, the final assets of the fund are counted as outflows. Reinvested dividends are not counted as inflows. We use fund-level reinvestment rates to improve accuracy in this respect. We make ad hoc adjustments for unusual corporate actions such as reverse share splits, and we overwrite our estimates with actual flows if managers are willing to provide the data to us. Please click here for a full explanation of our methodology.