The Index Trend Strengthens

Two years ago, I wrote a column that began: "Do active funds have a future? To cut to the chase: apparently not much."

When I said that, index funds were enjoying record-breaking sales and active funds were in net redemptions. But those numbers alone were insufficient evidence to conclude that active funds faced real trouble. Just as recent fund returns prove to be an unreliable guide for the next few years' returns, so too can sales trends reverse. That active funds were bleeding assets in 2014 didn't mean that they would still be doing so in 2016.

But when I studied the details, the case for active management looked worse than suggested at first glance, rather than better. The sales figures weren't hiding good performance by the active funds--for most categories, for most time periods, the index funds had the higher returns, usually with less risk. Also, the biggest sales successes for active management, international-stock and allocation funds, were vulnerable. As investor awareness grew, I argued, the "pendulum could soon swing" toward indexing in those areas, too.

Indeed it could.

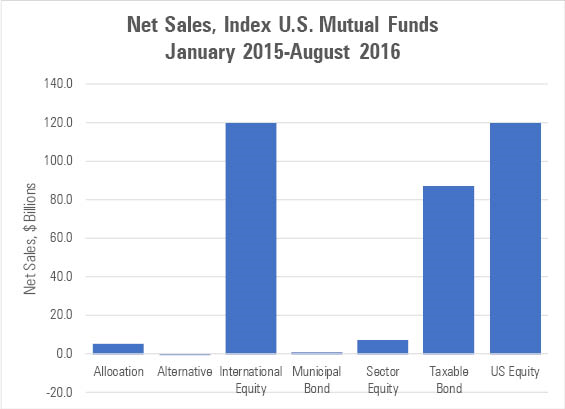

Below are the asset flows for U.S. index mutual funds, for 2015 and year-to-date 2016. All investment segments are positive, except for the tiny alternatives group, where indexing has yet to take hold. (In contrast, municipal-bond index funds are gaining some traction. The inflows are small when compared with those in other investment areas, but they are positive, and the word is starting to get out.)

At $5 billion, net sales for indexed allocation funds might seem unimpressive, until you see the figures for the active funds. And the numbers for international-stock funds have exploded. At just less than $120 billion for the 20-month period, net inflows for indexed international-stock funds have caught up with those for domestic-stock funds. The pendulum has indeed swung.

And Active Management Weakens

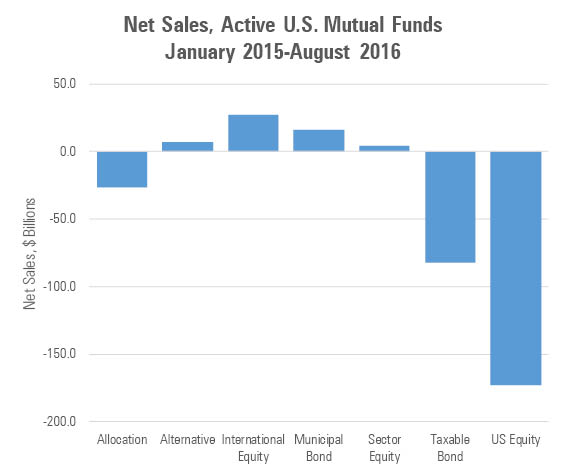

The news for actively managed funds has been glum. The bottom completely fell out of the allocation and international-stock sectors, with annualized net sales plunging from a combined $150 billion in summer 2014 to negative today. Redemptions of active U.S. equity funds have increased since 2014, and the onetime bright spot of alternatives has disappeared. The only good cheer, such as it is, comes from a modest resurgence in municipal-bond shares.

Unfortunately for active management's cause, the above analysis excludes exchange-traded funds. The charts reflect solely the sales from open-end mutual funds, which control only a portion of index fund assets but nearly all actively run assets. Adding ETFs to the equation gives index funds another $300 billion in inflows for the 20-month period while adding nothing to the totals for actively run funds. If this were a Little League matchup, the mercy rule would be invoked.

As in summer 2014, it's hard to see what will derail this particular train. The major U.S. and international-stock indexes are once again outperforming the average actively managed fund, for 2016 to date. With fixed-income funds, the Barclays U.S. Aggregate Bond Index isn't faring so well, performing about in line with the typical active bond fund, but active managers will require more than parity to reverse the sentiment. To change investors' minds, active bond funds will need to beat the Aggregate Index by a wide margin and for a long period of time.

Same as It Ever Was

The most common investment mistake is to extrapolate what has occurred in the recent past, say, the trailing three- or five-year period, and assume that the trend will continue. For that reason, I have been wary of predicting continued, uninterrupted success for index funds. There must be some things--some market conditions--that can embellish active management's reputation. If not to the glory days of the 1970s and 1980s, then perhaps to the semirespectability of the early 2000s.

But as in summer 2014, I don't see how and when it can happen. The groundwork does not look to be laid. It is not as if active management is being unjustly punished for having relatively good performance, or there are a large number of happy ongoing exceptions to the general rule, or active managers collectively are making a large bet against an index, a bet that could pay off in a major way. (Perhaps that could be said of some active bond funds, because of their underweighting of Treasuries, but not of active stock funds.)

The fortunes of active managers look as they did two years ago. And that is not good.

John Rekenthaler is Vice President of Research for Morningstar.