The lost decades in Japan have become one of the defining investment stories of our time. Since the 1989 stock market highs, the country has gone through a sustained period of weak economic growth with intermittent recessions and periods of deflation that has resulted in GDP that is practically unchanged in nominal terms. As a result of the asset price deflation that has accompanied these economic woes, both equities and residential property remain below their 1989 highs.

This has created a fascinating situation, with an extended period of stress and many false starts. In an attempt to end the ongoing trauma, promote growth and counteract the deleveraging in the private sector, the government of Japan has increased leverage significantly to become one of the world’s most indebted countries, with debt to GDP at over 200%.

The question long left unanswered is whether Japan is ready to turn the corner and enter a period of sustained economic expansion. If it does turn around, as many think it is ready to, unloved Japanese equities could be an attractive long-term position offering diversification benefits and the potential for gain as prices return to more normal levels.

However, this sanguine outcome is predicated on Japanese companies escaping the shackles of poor profitability that has been a defining feature for the best part of two decades. To assess the potential for improved profitability, one must acknowledge what has gone wrong and why. One of the most cited problems has been weak corporate governance, which has resulted in poor dividend policies, obscure compensation schemes, a lack of appropriate risk taking, a very low percentage of independent directors and high cross-shareholdings making merger and acquisition activity problematic. Companies have also failed to target appropriate profitability metrics, leading to high cash holdings and a general perception that they fail to act in the best interests of shareholders.

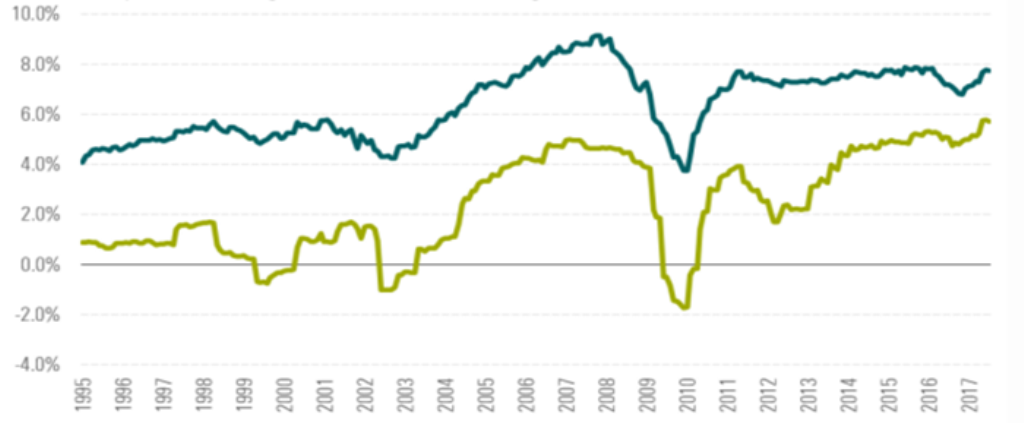

A lack of profitability has been an ongoing problem in Japan, lagging global peers

Source: Morningstar Investment Management calculation to 31/08/2017

With so many underlying issues, investors have been yearning for a catalyst. In 2012, along came Abenomics and the so-called “Third Arrow”, as Prime Minister Shinzo Abe introduced several measures that went about trying to stimulate economic growth and address some of the profitability issues that have plagued Japanese companies. As a part of this response, Japan’s Corporate Governance Code eventually came into effect on June 1, 2015.

Sceptics were quick to question whether the government could influence the fundamental structure that held back corporate Japan for so long. For example, we knew in Japan that very high cash holdings were associated with a low percentage of independent directors, but it wasn’t clear whether government regulation would meaningfully shift that cash into shareholders’ pockets.

With a few years of evidence now under our belts, we are in a far better position to make these assessments and there are some clear positive developments. One of the most encouraging has been profitability targeting by corporate management, which has increased rather dramatically.

As intended, independent directorship has also increased significantly, with the Corporate Governance Code acting as an effective method for change. This is undoubtedly encouraging, but it is worthwhile remembering that it will only be helpful if it drives outcomes such as increased payouts to shareholders.

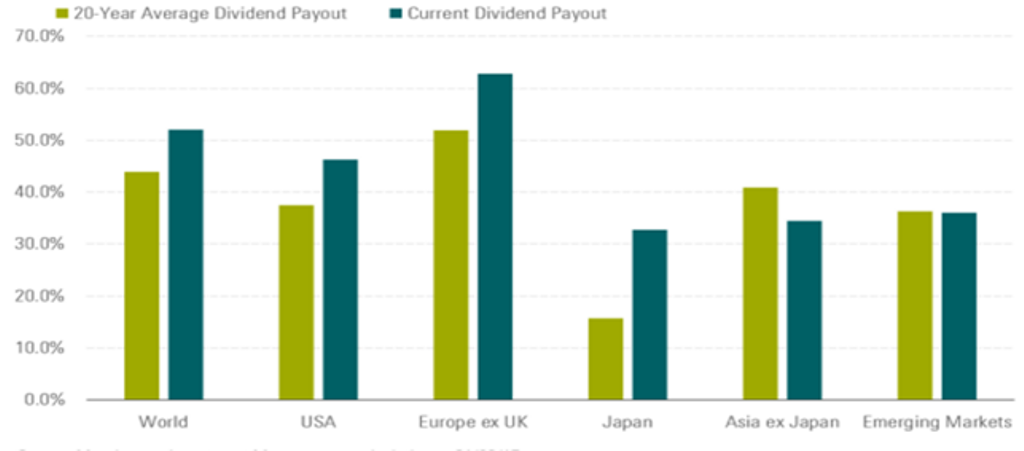

In respect to payouts, we are seeing newfound success, with dividends in absolute terms increasing across the board and payout ratios experiencing significant growth. Buybacks have also grown in popularity, which only became a legal practice in 1994, as the number of companies initiating their first buyback program continues to increase. We believe that these developments are likely to be both structural and profoundly important for investors.

Dividend payout ratios have increased markedly and are now closer in line with global peers

Source: Morningstar Investment Management calculation to 31/08/2017

There are other influences which must be considered too. For starters, favourable currency trends have played their part, with the ¥/$ rate moving from around 76 in 2011 to 115 as at July 2017. Industry concentration also remains low and whilst some evidence of consolidation is apparent in pockets, the level of mergers and acquisitions is not widespread enough to cause structural shifts in profitability. Leverage will be another key issue going forward, where we are seeing early green-shoots of corporate borrowing ticking up across the board for the first time in decades.

With positive developments evident in the Japanese corporate sector, investors must also consider how much is priced in and whether the opportunity is complementary in a portfolio context. To do so, we employ our four pillars of conviction, which is our way of considering the holistic opportunity under a long-term, valuation-driven framework. In this regard, we want to address the absolute return, relative return, fundamental risk and contrarian indicators.

Looking at these together, we find that Japanese equities look reasonably attractive – with valuations that look slightly expensive relative to history but clearly favourable when compared to other key markets. Japan also lines up well with other opportunities such as European telecommunications and US Healthcare, providing reasonable forward-looking prospects and a profile that offers diversification benefits to investors.

From a fundamental risk perspective, there is still some volatility in the cash flows and indications that profitability may be nearing a cyclical high. However, this is offset by strong balance sheets and a structural tailwind of improving corporate governance. With scope for added leverage, this could influence profitability improvements that would further narrow the gap to global peers. Overall, we view Japan as a “Medium” conviction opportunity, reflecting developments that are both captivating and compelling.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell a security or securities noted within nor should it be viewed as a communication intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation.