Emerging markets debt has surged in price. Local-currency debt, represented by the J.P. Morgan Government Bond Index-Emerging Markets (JPM GBI-EM Global Diversified), jumped over 14% in the first eight months of 2017, while hard-currency (or “external”) debt (the JPM EMBI Global Diversified Index) rose 9%. Those increases far outpaced the Barclays Bloomberg US Aggregate Bond Index, which returned just 3.6% in the period.

Asset flows paint a similar picture. Investors who fled emerging market debt late last year returned en masse this year, as asset flows to both local and external emerging market debt have approached record highs throughout 2017. But where has this rally left the asset class in terms of attractiveness from a valuation perspective?

Looking under the hood, we continue to find the yield on local-currency emerging markets debt compelling. The JPM GBI-EM Global Diversified Index was yielding over 6.0% in nominal terms at the end of August (the above chart is in real terms) — which is down by a percentage point since the start of 2016, but still appealing relative to history.

Our enthusiasm for this asset class is tempered, however, by emerging markets currencies as they’ve rallied over 7% versus the US dollar since the end of November 2016, and with a volatile performance profile, we could easily see this reverse.

The same is not true with hard-currency emerging market debt. As these are generally tied to the US dollar, a swift currency decline is not such a danger. However, the spread between the current yield and the US Treasury yield has fallen to 3%, which is below our fair value spread of 3.4% and a good drop from the 4.6% spread in January 2016. For this reason, we no longer feel that hard-currency bonds offer a compelling risk-reward tradeoff.

At the beginning of 2016, we saw an opportunity in emerging markets debt based on valuations. In 2015, a commodity bust—along with structural issues such as high inflation, disappointing growth, and political turmoil in some countries—had put a 25% dent in the Bloomberg Commodity Index, which contributed1 to an almost 15% drop for both emerging market equities and emerging market local-currency debt. Hard-currency emerging market debt held up somewhat better, although it returned a paltry 1% in 2015.

Yet, declines weren’t constrained to 2015. Local-currency bonds had also notched up substantial losses in 2013 and 2014, driven in part by the almost 35% rise in the US dollar versus the currencies in the local-currency emerging market debt index.

This sustained pounding of emerging market debt inflated the index’s yield to 7.1% by the end of 2015. Attractive yields combined with competitive exchange rates led us to believe the reward for risk looked attractive.

The question was whether the opportunity would help portfolios and in what size. Distinctively, beaten-up asset classes often present buying opportunities for valuation-driven investors like us who look for chances to buy assets investors have fled, as depressed prices typically offer greater potential for future return. We were therefore willing to take a contrary stance if it would help our portfolios to achieve better long-term outcomes.

A significant part of our reward-to-risk assessment is the underlying fundamentals (or drivers) of an asset class. We considered these to be improving in early 2016 even though many investors had abandoned the asset class and pushed valuations lower. Generally, at that time there were improving current account balances, structural policy reforms and economic growth that was picking up for the first time since 2010. This set the stage for improving government balance sheets and a trend where overall demand in these economies was becoming increasingly domestic and intra-emerging markets rather than reliant on developed markets.

Buy low and stay the course

In the first half of 2016, our conviction in both local- and hard-currency emerging market debt grew based on our views on valuations and fundamentals. Of course, there was uncertainty, notwithstanding our due diligence and analysis, and sizing had to reflect the unknowns we faced (it is worth noting we also liked emerging market equities, so our overall emerging market exposure had to incorporate this).

However, one point bears emphasis – our long-term investment process allowed us to stay true to our conviction through a difficult period. On this basis, we continued to have a reasonably high conviction for both emerging market debt asset classes in November 2016, when the market response to the surprise election of Donald J. Trump was swift and harsh to emerging market asset prices. The hard-currency index slid 4.1% that month, while the local-currency index and emerging market currencies dropped 7.0% and 5.1%, respectively.

“The market” feared the new administration’s policies would emphasise protectionism and fiscal expansion. Protectionism could hit emerging markets’ growth by hindering their ability to trade freely, while fiscal expansion—so the theory went—would stoke U.S. growth and lead to a stronger US dollar. A strong dollar can hurt external debt investors by making it harder for emerging markets borrowers to pay off debt, while U.S. investors in local-currency debt can lose money from an unfavorable exchange rate.

While this development was certainly painful in the short term, we stuck to our investment framework. We examined asset prices and fundamentals, and we tuned out trade policies, U.S. politics, and four-year forecasts. Predicting which policies the Trump (or any) administration might implement was not (nor ever will be) a game we want to play. At the time, it was far too soon to determine what type of impact the new administration would have on long-term fundamentals, and therefore fair asset prices. So we did not see a strong enough reason to change our thesis. What we saw was that the range of potential outcomes had widened—there were additional risks worth considering. On the other hand, prices had just become quite a bit more attractive. Investors had once again fled the asset class, yields had spiked, and emerging markets currencies had depreciated against the US dollar.

In fact, given how far prices had fallen on the local-currency side, we had increased our conviction level. This illustrates an important differentiator at Morningstar’s Investment Management group: a behavioural advantage. We can’t predict the future, and certainly not every investment idea will win the day. But we can stick to our valuation-driven process. We believe this will give us, over the long term, more investment wins than losses.

Bringing us to today

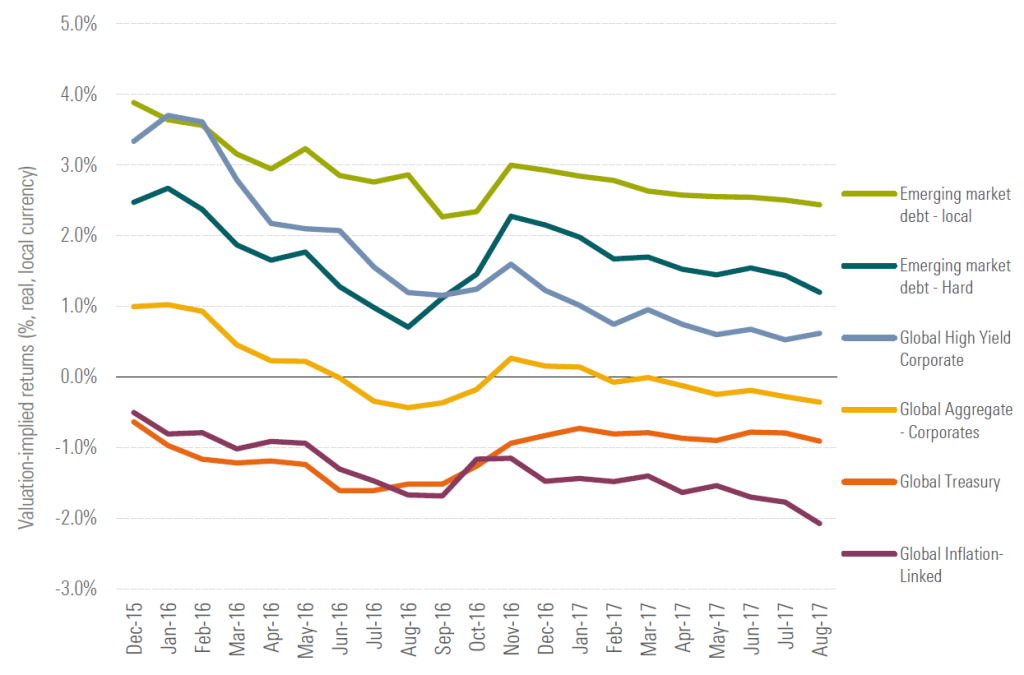

Emerging market debt is not nearly as attractive as what it was back in early 2016, however we still believe local currency debt warrants an investors attention. This is especially true on a relative basis, where we can see strong valuation-implied returns for local currency debt relative to many other markets.

Source:FRED, Morningstar Investment Management Calculation to 2017/08/31

We note that returns must be balanced with an appropriate risk assessment. In this regard, one must be careful with emerging market currency risk – as it has a strong tendency to fall during times of stress – and the asset class has a higher correlation to equities through the cycle. Therefore, even though we consider local currency asset class and hard currency debts would perform better than any other fixed income asset, sizing must reflect the inherent challenges faced to ensure portfolio outcomes are managed appropriately.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell a security or securities noted within nor should it be viewed as a communication intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation.