One of the pillars of virtually every investment thesis for emerging-markets stocks is these countries’ current or potential growth rates. The rationale typically follows the line that sustained high economic growth will fuel high rates of return for their respective stock markets. This reasoning is more fantasy than reality. Economic growth and stock market returns have generally moved in the same (positive) direction over long stretches of time. But there is little if any evidence to support a relationship between annual economic growth and stock market returns. History has shown that this is the case not only for emerging markets, but also for developed nations like the United States.

Gross domestic product is the broadest and simplest signal to use for measuring a country’s economic growth. It is the sum of four components: personal consumption, business investment, government spending, and exports minus imports. Based on these constituents, there would seem to be a reasonable argument that the returns generated by publicly traded companies could be related to economic growth. Consumers or government agencies purchase the goods and services produced by these firms (personal consumption and government spending). This activity generates profits that these companies can use to reinvest and grow their businesses (business investment). And firms can export their products for sale in foreign countries (exports minus imports). From January 1971 through December 2016, U.S. GDP grew at a nominal rate of 6.4% annually. The total return of the U.S. stock market, as measured by the Wilshire 5000 Index, was 10.6% per year during the same period. While different in magnitude, they were at least similar in direction.

A similar situation has occurred in developing nations overseas. China, for example, has experienced tremendous economic growth in the past several decades. From January 1995 through December 2016 its nominal GDP grew by 14.5% annually. But investors that used this strong economic growth to justify investment in Chinese stocks were no doubt disappointed. Despite exuberant economic progress, the annual total return of the MSCI China Investable Market Index was a scant 2.1% during the same period. Like the U.S. the magnitudes of these two metrics were very different but similar in direction. In 2005 Jay Ritter, a professor at the University of Florida, published a comprehensive paper on the subject of economic growth and stock market returns for 16 countries. His results confirm the relationships mentioned above, that economic growth and stock market returns move in the same direction across several decades or more but vary greatly in magnitude. Ritter’s data set goes back to 1900, demonstrating that these trends have been robust over the long run.

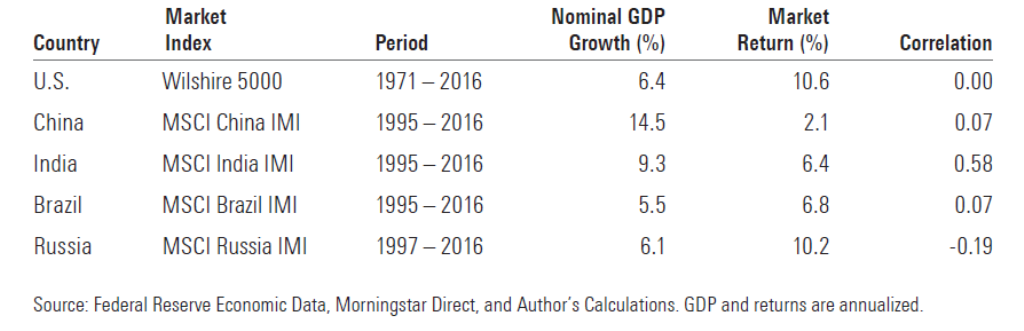

While long-term trends may be similar, Ritter also showed that the correlation between annual economic growth and market returns in these countries were negative. His analysis ran from 1970 through 2002 for developed-markets countries, and 1988 through 2002 for emerging-markets countries. Using annual data from the Federal Reserve Economic Database and MSCI, I examined the correlation between annual nominal GDP and market returns for the U.S. and four of the more prominent emerging markets during the past two decades. The results in Exhibit 1 show that economic growth and stock market performance in each of these countries had a near-zero or even negative correlation from the mid-1990s through 2016. The one exception was India, which had a mild positive relationship between nominal GDP growth and total market returns.

Exhibit 1 Correlation Between Market Returns and GDP for Various Countries

Given Ritter’s findings, these results should not come as much of a surprise. Both data sets demonstrate that there hasn’t been much of a link between annual economic growth and market returns for these five countries. A stronger relationship between the two would require that corporate profits come mostly from a firm’s domestic economy. But many of the largest and most profitable firms in these countries are also major multinational companies that generate a substantial portion of their profits outside of their domicile. It’s also important to realize that unlike economic growth, stock markets are discounting machines. That is, stock prices are constantly adjusting to new information, including economic growth rates, as it becomes available. Therefore, stock prices and returns are likely to deviate from underlying economic conditions based on the expectations of market participants.

Given Ritter’s findings, these results should not come as much of a surprise. Both data sets demonstrate that there hasn’t been much of a link between annual economic growth and market returns for these five countries. A stronger relationship between the two would require that corporate profits come mostly from a firm’s domestic economy. But many of the largest and most profitable firms in these countries are also major multinational companies that generate a substantial portion of their profits outside of their domicile. It’s also important to realize that unlike economic growth, stock markets are discounting machines. That is, stock prices are constantly adjusting to new information, including economic growth rates, as it becomes available. Therefore, stock prices and returns are likely to deviate from underlying economic conditions based on the expectations of market participants.

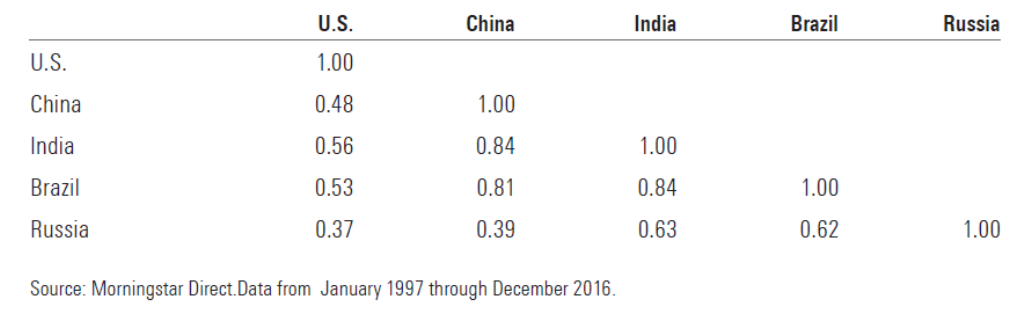

This doesn’t mean that stocks listed in emerging markets are poor investments. There are reasonable arguments to be made for owning stocks from these regions. They can expand an investor’s opportunity set, and the returns from stocks listed in these markets don’t always move in the same direction as those from the U.S. or other developed regions, which means they can provide a certain amount of diversification. The correlation matrix in Exhibit 2 shows how the returns from these various markets have behaved relative to each other.

Exhibit 2: Correlations of Stock Market Returns

While stocks listed in emerging markets can help diversify a portfolio of U.S. stocks, they also carry greater risk. From February 1988 through December 2016, the volatility of the MSCI Emerging Markets Index was 23.0% compared with 14.3% for the MSCI USA Index. There are other forms of stock-specific risk that investors should be aware of. For example, state-owned (or otherwise influenced) enterprises represent some of the largest companies in some of these countries, particularly in China. (State-owned enterprises are publicly traded firms that are partially owned by government agencies, thus introducing potential conflicts of interest between government interests and those of other public shareholders.) Diversification across stocks, regions, and countries is critical when investing in these markets.

The simplest way to approach investing in emerging markets is to start with a fund tied to a market-cap-weighted emerging-markets stock index. The expense ratio on each of these funds is among the lowest in the diversified emerging-markets Morningstar Category, which should provide them with a long-term advantage over their more-expensive category peers.