Fixed-income markets have enjoyed one of the greatest 30-to 40-year bull markets in history. With 10-year government bond yields falling from highs of over 15% in the early 1980s to lows of 2% today, the asset class has delivered unprecedented outcomes for cautiously-minded investors on a risk-adjusted basis. In many ways, fixed income has been akin to the world’s greatest defence in a football team, with an ability to score goals (deliver returns) and never concede (rarely suffering downside risk). At this juncture, it is therefore healthy to remind ourselves of the two key roles lower-risk bonds play in a portfolio: 1) as a source of return, and 2) to diversify equity risk. We explore these two key roles in detail, showing the implications as we consider fixed income exposure in the current context.

Fixed income as a source of return

When comprehending the opportunity presented by fixed income at current levels, we advocate that investors focus on what is knowable and draw lessons from history. In this regard, we know from broad perspective that the landscape is markedly different –leading to a situation where lower returns are expected and the sensitivity to interest rates is higher.

The lower return expectations tie in to valuations. With low bond yields, valuations are generally considered at the outer bounds of normality. The prognosis from such a position is one of two viable scenarios. First, valuations could remain at the outer bounds of normality, where yields remain low. In this case, major declines from bond markets are unlikely, although the return backdrop is likely to be lower due to the compressed starting yield. The alternative would be for valuations to revert, where we would likely see negative returns followed by something closer to normality. The greater sensitivity to interest rates is a result of duration. As inflation pressures have subsided, governments have been incentivised to lock in low rates for longer periods of time. This phenomenon is far more prevalent in some markets than others, but the basic premise has been lower rates locked in for longer.

As can be seen, this evolution has changed the maturity profile of the market, and unbeknownst to many investors, has also acted as a further tailwind to returns as the price of longer-dated bonds is more sensitive to interest rate changes. Yet, the difficulty does not necessarily reside in understanding this relationship looking backwards –the true challenge is understanding what it means looking forwards. The point here is to acknowledge is that market conditions matter, which leads us to a conversation about the role government bonds can have in a portfolio based in the current challenging landscape.

Diversification against an equity shock

It is useful to pause at this point and contemplate what a bond truly is –if held to maturity, it is an instrument that offers a capped upside (coupons) with an extremely low risk of default. However, the majority of investors don’t buy government bonds directly, and thus, need to consider the secondary market to understand how protective these assets will be during periods of stress.

Specifically, it is the ability to buy and sell in a secondary market where the diversification benefit is obtained. Typically, a conversation about diversification will inevitably end in an assessment of correlations. The theory is that when stocks go up, bonds go down; and vice versa. Yet, it is worth contemplating broader history because this can be grossly misleading over extended timeframes.

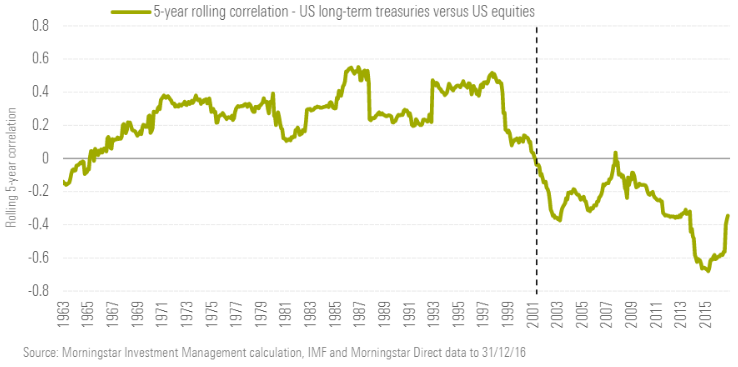

Exhibit 1: The correlation between fixed income and equities is not constant

In the chart above, we can see the correlation between stocks and bonds over time. By charting the rolling five-year average, we look through the noise and can see a material difference in the average correlations between the late 1900s and the post-2000 era. While some may justify this by pointing to distinctly different inflationary pressures during each period –for example, 1970 to 1990 was a period of high inflation, while the 2000s have been benign –we believe that generalisations of this nature rarely help the investor and may not be representative of the future. More dangerously, in our view, is to extrapolate the last 15 years of negative correlations and simply expect it to continue into perpetuity. This would ignore the current state of yields (in both nominal and real terms) and entrench an investor in the recency bias (our behavioural tendency to extrapolate recent trends).

Specifically, we want to go beyond generalisations and average correlations –instead focusing on the possibility for different types of equity shocks and how it might affect bond yields. A particular emphasis on the pre-1980 period could be useful in this regard, as rising interest rates had a meaningfully depressive impact on both equity and fixed-income returns. This must be respected as a potential scenario from current levels, with a recent uptick in inflation showing that this is indeed possible. In fact, by looking back through the 1963 to 1980 inflationary period we find that the average correlation between equities and bonds was mildly positive (averaging 0.21), however, bonds were still protective when they were needed (averaging an annual return of 3.1% during equity drawdowns).

Bringing this into a portfolio context

The above information helps us to differentiate between longer-term returns and crash protection. By extension, it also helps to determine whether fixed income should play a role in a portfolio if it offers low return expectations. We find that when equities sell off and diversification is needed, fixed income can indeed be useful as a true diversifier. Therefore, the lesson when sizing positions is to think holistically about the benefits and avoid the temptation to use average correlations.

Conceptually, this might sound complicated with a lot of moving parts. Yet, what we are really trying to understand is the holistic profile of the investment universe and how the bond markets can best be utilized given the state of the broader opportunity set. It may be an onerous process, but by putting a lot of effort into understanding true diversification at a portfolio level, we can understand the intricacies of the exposure and ultimately our portfolio risk. If we go back to the football analogy, we know that a well-constructed team requires a mix of strikers, midfielders, and defenders. For government bonds, they may not offer much by way of attack (poor long-term return prospects), but have had an ability to hold up defensively when called upon (especially if equities sell off).