Often investors and their advisors set up active and passive investing as a dichotomy—either seek outperformance from actively managed funds or cut costs with passive solutions. However, depending on the objectives of a portfolio, we find value in making the most of both approaches by choosing the right fit to best express each investment idea. We’ll explore our philosophy to active/passive investing, ultimately illustrating how an active and passive approach gives us flexibility to add value through not only the possibility of outperformance or lower costs but through precise implementation of our investment ideas.

Early thinking on the active/passive decision was based primarily on the idea that active management has a greater chance to be effective in less-efficient markets, which was supported by the findings of a 2014 paper by Morningstar Investment Management. The paper was primarily a US-based study, but intuitively confirmed that the average small-cap manager was more likely to top its benchmark than its large-cap counterpart, and that the size of the outperformance was also on average higher than that of large-cap managers. Similarly, emerging markets equity managers were found to be more likely to outperform their respective benchmark than other developed markets equity managers.

Interestingly, the study also showed that the dispersion among returns for U.S. large-cap blend managers was much less than that for other equity asset classes. In fact, many of the asset classes in which the average manager topped the benchmark over the period also showed greater dispersion among managers. This suggested that skilled manager selectors might be able to more easily differentiate between future outperformers and underperformers in certain asset classes, making them potentially better suited to active management than others.

New opportunities in active/passive

While many investors position their active-passive investment approach along the “market efficiency” line of thinking (favouring active management in less efficient markets and passive management in very efficient markets) there are other reasons an investor might use a combination of active/passive solutions.

For instance, with a valuation-based investment framework comes the opportunity to improve active/passive investing, as a greater ability to precisely identify investment opportunities results in greater importance to match the range of products to the intended exposure.

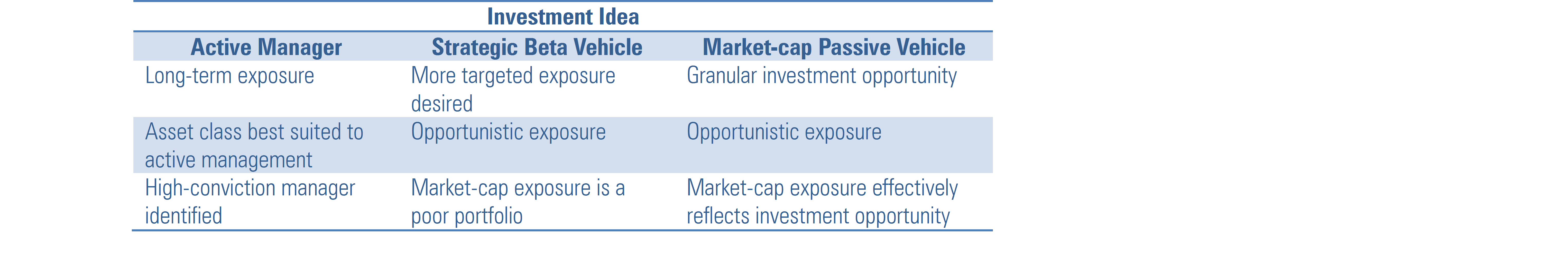

Said another way, as investment ideas percolate from our valuation-driven asset allocation process, our first decision is whether we should express the idea via an active manager or through a passive or rules-based strategy.

Exhibit 1: Combining active and passive gives us more ways to implement an investment idea

While the selection is dependent on the objective of the portfolio (for instance, active funds are rarely utilised in a portfolio where the objective is for fees to be minimised), we’ve found that having the flexibility to implement investment ideas across the active, passive, and even strategic beta spectrum is a very effective way to invest. Because there’s few actively managed strategies that focus on a particular region or sector, and even fewer that invest in a single country, the addition of passive and strategic beta products enables us to fine-tune our portfolios’ effective exposure to ensure they are positioned to take advantage of our highest-conviction investment ideas.

Where active management still rules

Despite the positive advancement of passive solutions, for some asset classes (such as high-yield bonds), we continue to retain a stronger conviction in active managers. Part of this justification comes from market inefficiency, but can also come from limited passive product advancement, competitive fee differentials, liquidity issues and poor benchmarking.

Underlying this, investors must not blindly select a passive solution, as the benchmark they are designed to track can often have quite different characteristics to the exposure desired. In these circumstances, due diligence is required to ensure the product matches the desired exposure, and in some cases, active management may be a better representation of the asset class view.

Remember the objective

It is imperative that investors think about active/passive holistically. This means getting the right exposure to the right assets and should encompass an ambition to maximise reward for risk at a total portfolio level. While returns aren’t guaranteed, fees are definite, so minimising fees should be an underlying principle when thinking about the investment selection process.

To us, this means utilising the best of active and passive via the following key tenets:

• Reduce costs where possible;

• Augment active managers where they meet our strict standards, but always be open to passive exposures if they match the desired exposure;

• When contemplating the above, always be aware of liquidity and trading risks; and

• Ensure the investment idea helps the portfolio achieve its objective.