If the U.S. stock market were a white-water rafting trip, its participants would demand a refund. These days, even a 1% daily move by the Dow Jones Industrial Average is rare. Holding stocks is like tubing the American River: lazily drifting on a summer's day, all cares forgotten. I'm not sure how CNBC stays in business.

As Bloomberg's Matt Levine points out, this decline in market volatility could indicate that investors have become more rational. Robert Shiller won a Nobel Prize, in part, for showing that stock prices overreact.

Historically, even routine news often sends the market into a frenzy. Take this 6% weekly loss from January 2016. (What on earth were we thinking?) If stocks are calmer today, perhaps that is because their investors have become wiser.

Levine is partially convinced: "A reader once proposed to me that the reason that stock market volatility is so low is that all of the volatility has moved to bitcoin. I think there might be something to this. One crude interpretation of this fact might be that people like to gamble, and the stock market has historically been a fun gambling venue, and so uninformed but enthusiastic trades would enjoy speculation wildly on the latest stock-market news."

Besides bitcoin, he writes, inveterate gamblers may also avail themselves of initial coin offerings (whatever those might be) and of sports websites. Twenty years ago, a young man living in his parent's basement--probably not literally, but that is the demographic--would satisfy his lust to wager by day trading stocks. Now, he can gamble without getting dressed in many other ways.

I won't break Levine's butterfly on the wheel, because he offered his hypothesis in passing, as one of several daily musings. Also, this subject does not lend itself to proof. But the thesis seems unlikely.

The Facts

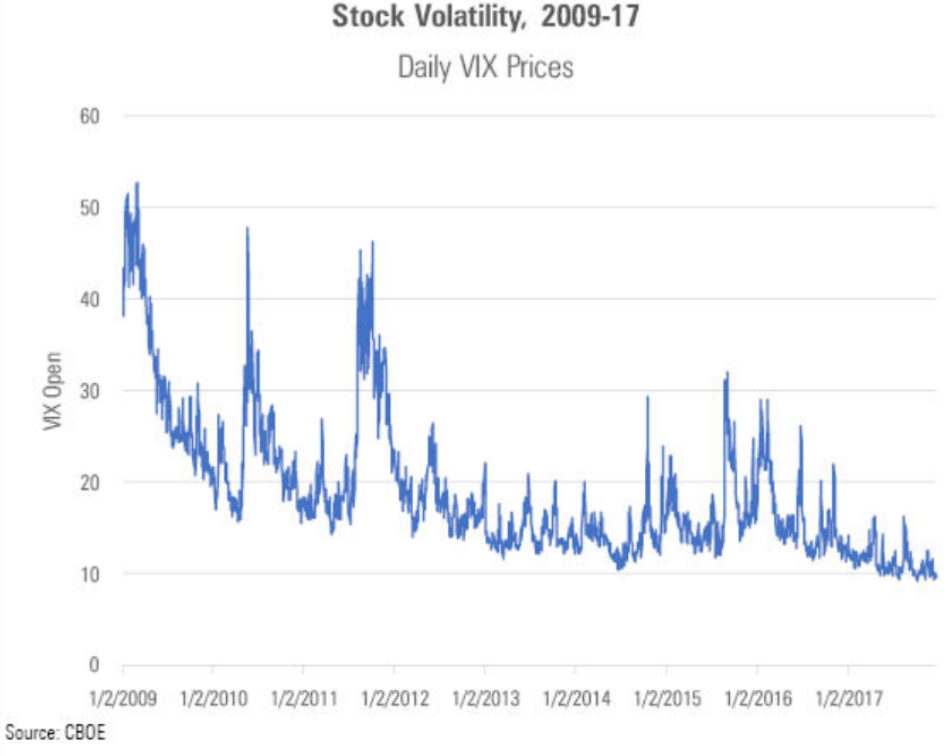

To start, he's certainly correct that stock market has become quieter. Below are the daily values for the CBOE's Volatility Index, or VIX, which measures expectations of the S&P 500's future volatility. Technically speaking, VIX does not portray actual volatility--it shows what investors believe will happen. In practice, though, the two are much the same thing, as investors expect chaos after chaos has occurred, and calm after calm.

In addition, Levine is right to believe that bitcoin chasing and fantasy football contests have replaced day trading. To the extent that any of the original day traders survived the 2000-02 tech-stock meltdown, they were wiped out several years later during the 2008 financial crisis. And new gamblers have been amply warned, by the success of index funds, about the great difficult of outperforming stock benchmarks. They hunt other game.

The Interpretation

I dispute not the facts, but instead the interpretation. My concern is that institutional investors control most U.S. stock-market assets. For Levine's claim to be true, the tail must wag the dog. That is, the minority of monies that are directly held by retail shareholders must drive most of the stock market's moves. This is possible, because what matters for stock behavior are the marginal effects of trades, not simply who has the largest stake, but I would need to see the evidence to believe that.

The implicit suggestion that retail investors gamble more than institutional investors also seems questionable. Day traders, to be sure, are a particularly noisy segment of individual investor but, I think, never particularly prevalent. Most direct stock holders are stodgy, being either buy-and-hold retirees or, very often, employees who are long-term owners of their company's shares. Meanwhile, plenty of institutional investors trade frantically--hedge funds, for example.

If the explanation to the downturn in stock-market volatility does involve changing investor habits, as opposed to another reason, I suspect that the answer lies with the institutions. Thirty years ago, they not only had much less power than they do today, but they wielded that power poorly, engaging in portfolio-insurance schemes that exacerbated the October 1987 market crash. Perhaps they are better actors today.

Perhaps. It is certainly true that a greater proportion of institutional assets is invested passively, such that those funds' portfolio managers will not be tempted to sell into a declining stock market so that they can outperform the bear. However, it would be rash to claim that institutional investors were once prone to herd behavior, using trading rules that led to unanticipated ripple effects, but now those problems have been solved. Just as in 1987, nobody knows how the current strategies and technologies will play out until another crisis occurs.

It's the Economy, Stupid

The simplest explanation, I think, is the likeliest: Stock-market volatility is down because the economic news has been duller than Sacramento in December. (For some reason, this column has transported me to 1974.) Every year, U.S. GDP grows by a percent or two in real terms; inflation is similar; and the rest of the developed world falls pretty much in line. Every year, corporate profits are higher than they were the previous year, dividends are up, and companies possess more cash. This year, that year...who can keep them straight?

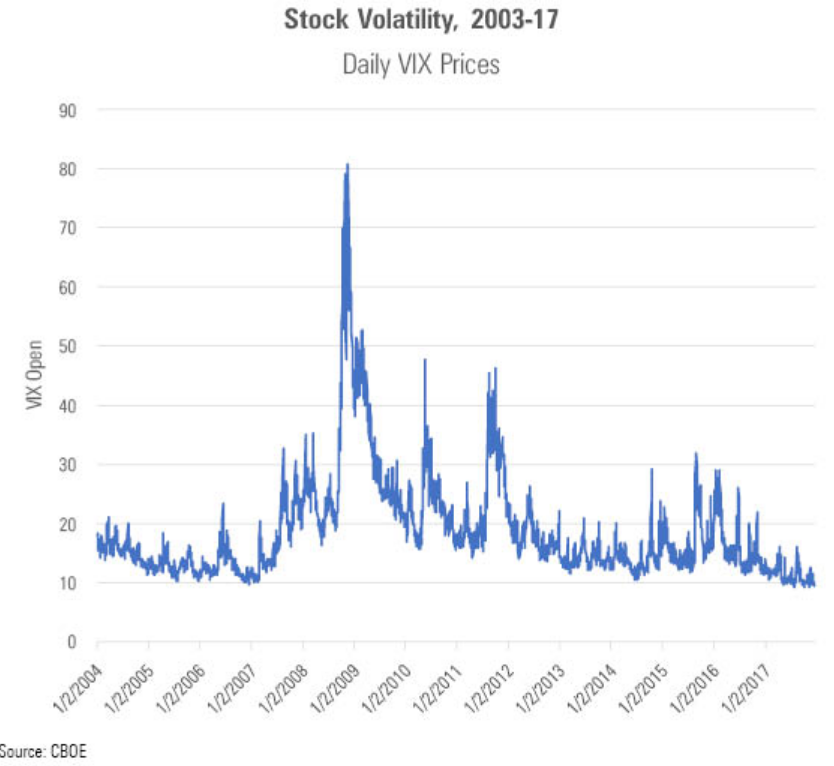

Let's take that initial chart back another six years, to the start of 2003, which is when the CBOE began its current version of the VIX calculation.

That tells a rather different story, doesn't it? The post-2008 trend for stock-market volatility is down, down, down; the numbers keep hitting new lows. However, if the analysis is extended to include the relatively tranquil period of the middle of last decade, then it doesn't appear as if much has changed. We are back to where we once were. And we know how that played out, once the economy stuttered.

In summary, I believe that today's lower stock-market volatility has been caused by the economy, not by changing investor behavior.