Over the long haul, the stock market has been a great investment, and it will likely continue to be. But its path is far from smooth. At times, it can be downright scary. Gut-wrenching volatility and ominous headlines can cause even seasoned investors to abandon stocks, which can derail a well-thought-out investment plan. That's why it's important to plan for the market's inevitable downturns before they happen.

The most effective way to reduce investment risk is to adopt a more conservative asset allocation. But many investors have a more aggressive asset allocation than they should (given their risk tolerance) because the stock market's returns are too tempting to give up, and it's easy to overestimate comfort with risk in an extended bull market.

A disciplined trend-following strategy can help investors who bite off more risk than they can chew. Trend-following is a momentum strategy that can be used to time exposure to an investment, based on the idea that an investment's (recent) past returns can help predict its (near-term) future returns. For example, a simple trend-following strategy may hold a stock index fund when its return over the past year is positive and sell it when its return is negative.

Trend-following can help cut risk while capturing most of the market's returns. That seems too good to be true, particularly for a market-timing strategy, but it has been undeniably effective.

Why It Works

Trend-following works because poor returns tend to cluster, and the strategy moves to cash before things get really bad. This clustering of poor returns arises partially because bad news tends to cluster. For example, a slowing economy can weigh on earnings and increase pressure to cut costs, leading to layoffs, higher unemployment, and weaker consumer demand, which may further depress future earnings. Rising economic risk can scare investors, pushing stock prices down further.

Investors can be slow to react to new information, causing market prices to adjust more slowly than they should. That's particularly true with respect to bad news because most investors are unwilling or unable to short stocks, and many investors buy the dips, viewing price declines as buying opportunities, even when the fundamentals have changed. These slow price adjustments mean that recent market losses may serve as an early warning sign that a downturn may be looming. Trend-following capitalizes on this by moving to the sidelines before the pain increases.

This strategy helps most during severe market downturns. But it can register some false positives, prompting a move to cash when market volatility picks up and short-lived declines are followed by better returns. This can cause trend-following to lag during extended market rallies. Yet, it has historically offered a more favorable risk/reward trade-off than a simple buy-and-hold approach and will likely continue to do so over the long term.

Historical Evidence

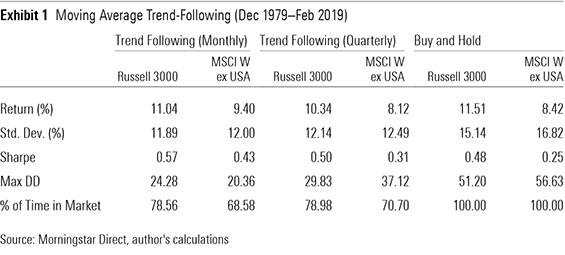

Despite its simplicity, trend-following is a robust tool for risk management. To illustrate, I created a simple trend-following strategy with the Russell 3000 and MSCI World ex USA indexes. Every month, I compared each index's current value with its average month-end value over the past 12 months. If the current index value exceeded its average over the past 12 months, the strategy held that index for the next month. If it fell below the average, it held one-month Treasury bills. I also ran a version of this strategy that updated only once per quarter. The results are shown in Exhibit 1.

This trend-following strategy was remarkably effective for both indexes, though it worked better with monthly rebalancing. Trend-following reduced volatility and losses, leading to better risk-adjusted performance (as measured by Sharpe ratio). Most importantly from a risk-management perspective, the trend-following strategies cut the maximum drawdowns of investing in stocks by more than half. This metric measures the cumulative losses that investors would experience if they had the worst timing possible.

Among U.S. stocks, trend-following (updated monthly) reduced returns only slightly compared with a buy-and-hold approach. That's better than expected. Even in bad times, stocks should always offer higher expected returns than T-bills, otherwise no one would take the risk of owning them. So, trend-following strategies should post somewhat lower returns than the market. Yet, this strategy held U.S. stocks 78.6% of the time but captured 95.9% of the Russell 3000 Index's returns.

The strategy worked even better among international stocks, earning higher returns than the MSCI World ex USA Index despite holding stocks only 68.6% of the time. And it led to an even larger reduction in the maximum drawdown.

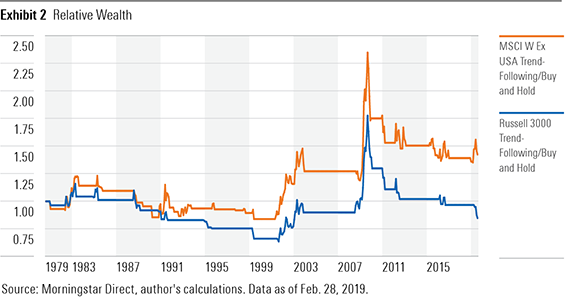

Performance won't always be this strong. Trend-following can lag the market by significant margins over long spans, as Exhibit 2 shows. (This chart illustrates the value of an investment in the monthly trend-following strategy compared with a buy-and-hold investment in each index.) But the good news is that underperformance tends to happen when the market is going up, and the strategy largely makes up for it by offering better protection.

In part 2 of this article, we will try to test the robustness of this trend-following strategy.