In part 1 of the article, we discussed how ESG risk would have impacts on enterprise value in the long-term. In this part, we will continue explore whether ESG risks is linked to performance.

No Clear Link Between ESG and Performance

Historically, there hasn't been a clear link between firms' ESG attributes and performance. That's likely because portfolio-level ESG risks have been low in the past, as many ESG issues that companies have faced have been firm-specific.

Morningstar's quantitative research team recently published a study showing firms across the globe with higher ESG Risk Ratings from Sustainalytics did not post significantly better or worse returns than their lower-scoring counterparts over the trailing 10 years through September 2019 (1). ESG leaders and laggards also exhibited similar volatility and downside risk.

In the United States and Canada, the study found top-scoring firms slightly underperformed the laggards, though the difference wasn't significant.

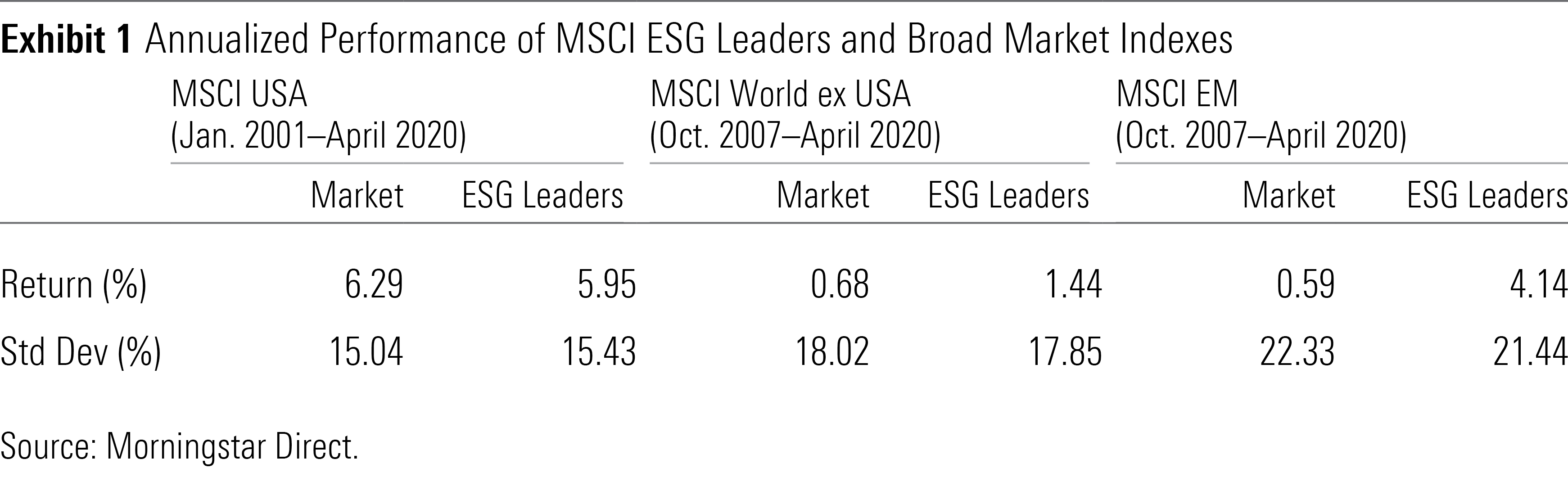

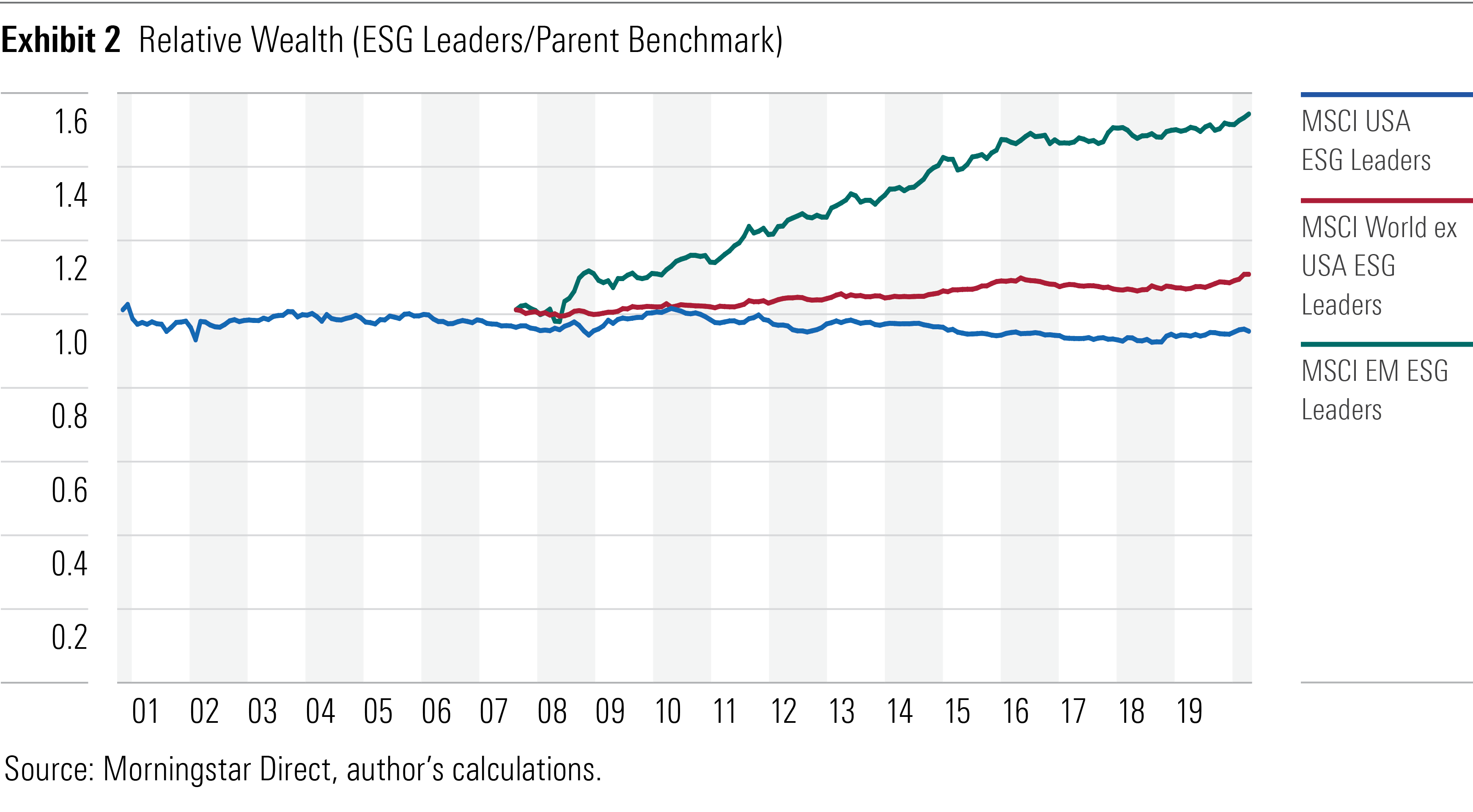

The performance of the MSCI ESG Leaders indexes are consistent with these findings, though they're slightly more favorable for the ESG portfolios. From its back-dated inception in December 2000 through March 2020, the MSCI USA ESG Leaders Index slightly lagged its parent index, as shown in Exhibit 1. However, among foreign stocks, the MSCI ESG Leaders indexes outperformed their respective parent indexes, though the data here go back only to September 2007. That outperformance was most significant in emerging markets. Exhibit 2 shows the relative wealth of each ESG index against its parent benchmark.

Overall, these data don't demonstrate a clear link between ESG traits and performance. The results are sensitive to how ESG is measured and the market in question. However, it's difficult to make a strong case for why ESG investing should work better in some markets than others. The differences across markets could be attributable to chance.

Will the Future Be Different?

Firms' ESG risks are likely growing and could become more highly correlated over time, if for no other reason than these issues are receiving more attention from consumers, regulators (particularly outside the U.S.), and investors. That shift may have important consequences for performance and create some attractive opportunities over the next several years.

If stocks share common ESG risks and the market does not fully appreciate them yet, firms with lower ESG risks could be undervalued and priced to offer market-beating returns. That mispricing would allow investors to derisk and increase expected returns, so it probably wouldn't last. If the market increasingly recognizes ESG risks as systemic, it should assign higher prices and lower expected returns to companies with lower ESG risk. The transition to that new equilibrium could push the price of ESG leaders up, helping their short-term performance at the expense of future expected returns.

So, while there may be a temporary return benefit to owning companies with attractive ESG characteristics, over the long term there could be an opportunity cost to holding those firms. However, that wouldn't entirely be a loss, because it would lower strong ESG firms' cost of capital, making it easier for them to grow and encouraging other companies to adopt sustainable practices to get a similar benefit. As Cliff Asness from AQR argues, that's precisely the point of ESG investing (2).

All of this is hard to predict. However, to the extent that ESG is linked to long-term returns, it will likely be valuation-driven.

Impact on Corporate Behavior

As more money shifts into funds that incorporate ESG, they will likely have a greater impact on stock prices, voting, and corporate behavior. That said, the influence ESG index portfolios have is often indirect. As they're already screening for firms with strong ESG practices, they don't do much engagement with the ESG laggards. Those laggards likely care about ESG issues only if they hurt their stock price or business, or cause investors to vote against management.

Look Under the Hood

There is no standard definition of ESG, so it's important to look under the hood of ESG-branded exchange-traded funds to know what you're getting. For example, Vanguard ESG U.S. Stock ETF (ESGV), which has a Morningstar Analyst Rating of Silver, offers broad exposure to the U.S. stock market and excludes only firms involved in certain lines of business, including fossil fuels, firearms, and vice industries. It doesn't directly consider governance issues or the environmental impact of its holdings.

In contrast, Silver-rated iShares ESG MSCI USA Leaders ETF (SUSL) considers financially relevant ESG risks in each industry and targets firms representing the half of the market with the strongest ESG characteristics relative to sector peers. So, its sector weightings are very similar to those of the market, and it owns some fossil-fuel-related stocks.

Even funds that appear to use similar approaches can end up with very different portfolios. For instance, like SUSL, Goldman Sachs JUST U.S. Large Cap Equity ETF (JUST) targets stocks with ESG scores in the top half of each industry. However, only slightly over half of their portfolios overlap, with stocks like Amazon.com (AMZN) and Apple (AAPL) appearing in JUST but not SUSL.

The best approach to ESG for one investor may not be right for another. However, investors concerned about the financial impact of ESG risks should consider funds that use that perspective, like those that track the MSCI Leaders indexes.

Analyst Ratings for ESG funds are based on our analysts' assessments of how well the funds will likely perform in the future relative to their peers, not how well the funds are delivering on their ESG mandates. ESG screens may help mitigate exposure to firms with long-term tail risk, but that benefit may be partially offset by the reduction in diversification from excluding ESG laggards. Top-rated funds effectively balance that trade-off.

References:

1) Wang, P., & Sargis, M. 2020. "Better Minus Worse." https://www.morningstar.com/insights/2020/02/19/esg-companies

2) Asness, C. 2020. "Virtue Is its Own Reward: Or, One Man's Ceiling Is Another Man's Floor." https://www.aqr.com/Insights/Perspectives/Virtue-is-its-Own-Reward-Or-One-Mans-Ceiling-is-Another-Mans-Floor