We just published our “Passive Sustainable Funds: The Global Landscape 2020”. In this report we assess the global landscape of passive sustainable funds to illuminate the choices currently available to investors globally. The report focuses on the two regions where these funds have seen the greatest adoption, Europe and the United States.

Key Takeaways

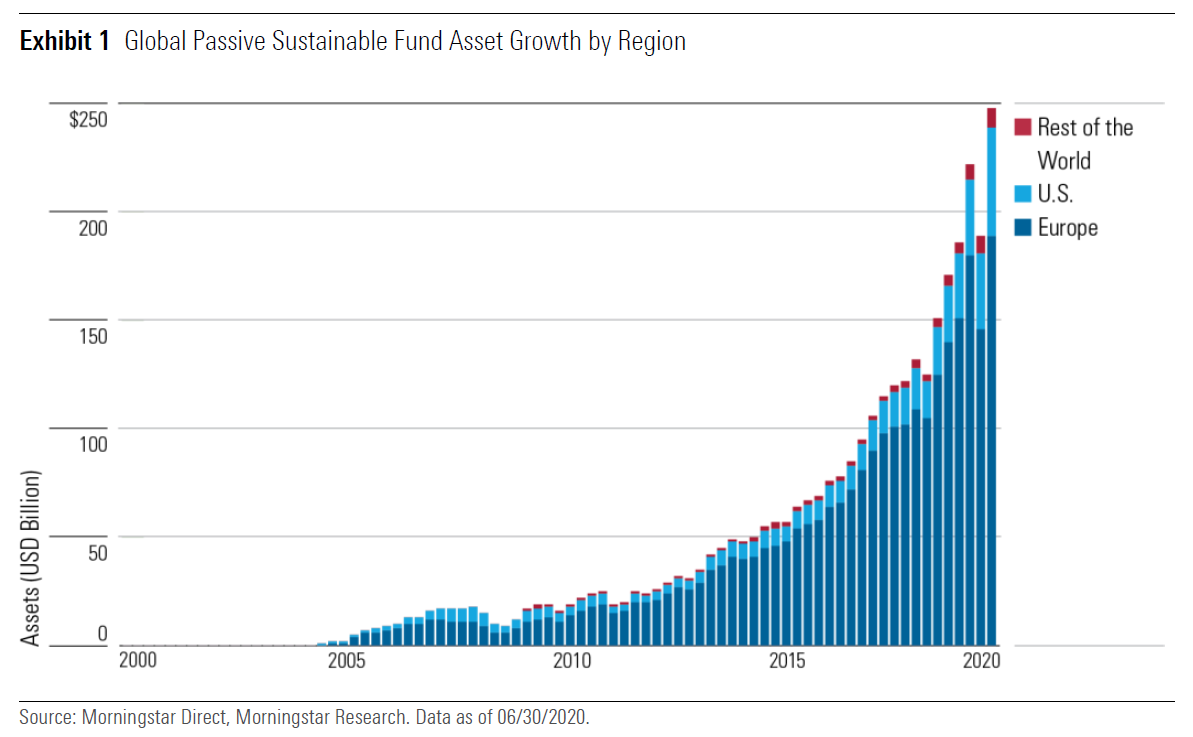

- As of June 30, 2020, there were 534 sustainable index mutual funds and exchange-traded funds globally, with collective assets under management of US$250 billion. Both the number of products and the money invested in them have more than doubled over the past three years.

- Europe remains the largest market for sustainable passive funds, accounting for more than three fourths of global assets. The U.S. represents 20%, up from 13% three years ago.

- For all the growth in global assets, the development of the passive sustainable fixed-income space remains at an embryonic stage, particularly outside of Europe.

- The universe of passive sustainable funds represents a broad range of approaches addressing various sustainability and investment objectives. In this paper, we have subdivided the sustainable passive universe into smaller groupings: Exclusions-Only, Broad ESG, and Thematic. There is often a trade-off between sustainability exposure and tracking error.

- While passive sustainable funds tend to charge higher fees than their plain-vanilla peers, in some markets, investors can now choose from an expanding range of sustainable fund options with little or no fee premium versus their conventional counterparts.

- Key considerations for investors when choosing a passive sustainable fund include sustainability focus, approach, data metrics, sector and geographic biases, tracking error, and fees. Selecting a responsible asset manager who votes company shares and engages with companies on a variety of environmental, social, and governance issues is also important.

Europe and the U.S.

Europe’s dominance is largely a reflection of the age of its sustainable fund market. Asset levels are supported by institutional investors with sustainable mandates, particularly Scandinavian public pension, sovereign wealth, and insurance funds. Individual countries such as France have introduced mandatory climate-related reporting for institutional investors that has further forced sustainability onto the investment agenda.

Home to the largest fund market in the world, the U.S. has historically been reluctant to embrace the concept of sustainable investment. This appears to be changing. Passive giants such as BlackRock have publicly placed sustainability as a key objective, forcing ESG into the mainstream.

Rest of World

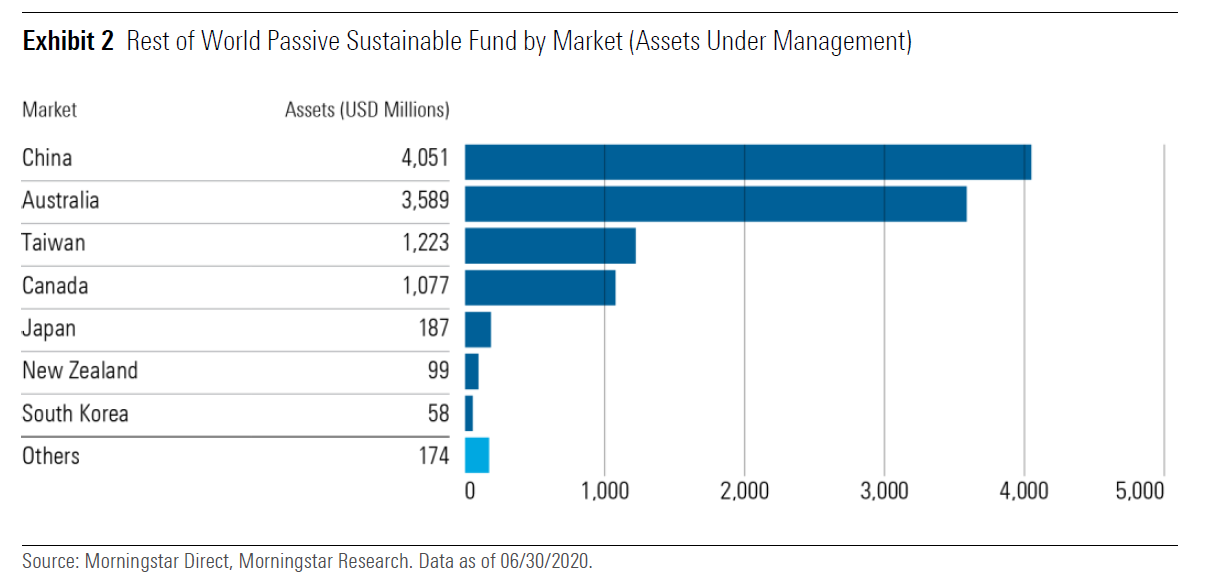

Outside of Europe and the U.S., the speed and enthusiasm with which investors have embraced sustainable investing has varied, and this is reflected in the low uptake of passively managed sustainable funds. As of June 30, 2020, assets in passive sustainable funds domiciled outside of Europe and the U.S. totaled US$10.5 billion, representing 4.2% of global assets. The growth in the past three years has been driven mainly by net inflows into new product launches, especially in Australia, Canada, and China. The latter is now the largest market in passively managed sustainable funds outside of the U.S. and Europe, with assets under management of US$4.1 billion. In Hong Kong, there were only two passive sustainable funds as of end-June 2020.

These low numbers, however, do not tell the full story. There are other areas in which investors have further endorsed passive sustainable investing. The prime example is Japan’s Government Pension Investment Fund. The GPIF’s investment in ESG indexes in the form of mandates was increased by 63% as of March 2020 from a year ago to JPY 5.7 trillion (or $52.8 billion).

China

As noted in Morningstar’s “Global Investor Experience Study: Regulation and Taxation,” published in April 2020, the Asset Management Association of China released a guideline on green investment in November 2018 to standardize ESG investment activities1. According to the guideline, fund managers engaged in green investment are required to file annual self-evaluation forms with the AMAC.

In the passive sustainable space, product development has been concentrated on environmental themes. As of the end of June 2020, 16 of the 20 passive sustainable funds in China target an environmental theme. Six of these target China A-shares stocks involved in the new energy vehicles industry.

All 20 passive sustainable funds invest in the China A-shares market. The assets under management of these funds totaled US$4.1 billion. The ChinaAMC CSI New Energy Car Industry ETF 515030, listed in March 2020, quickly gathered assets and became the largest sustainable passive fund outside of the U.S. and Europe by the end of June 2020. With assets under management of US$1.4 billion, the fund is among the largest 10% of sustainable passive funds globally.

Taiwan

Taiwan only houses three passively managed sustainable funds, two of which were launched in 2019. Despite the tiny menu, the total assets under management of these products totaled US$1.2 billion as of the end of June 2020, making it the third largest market outside of Europe and the U.S., after Australia and China. All three products were ETFs, including one tracking China green bonds. Shin Kong China 10-Year Treasury Bond and Policy Financial Bond Green-bond-enhanced ETF 00774B has assets under management of US$757 million, putting it as the third largest sustainable passive fund outside of Europe and the U.S.

1 Green Investment Guideline: https://www.amac.org.cn/industrydynamics/guoNeiJiaoLiuDongTai/jjhywhjs/esg/202001/P020200120441036297434.pdf