In part 1 of this article, we discussed some of the considerations on the index when choosing a passive sustainable fund. In this part, we will continue looking at the index level and also discuss the considerations on the fund level.

Even within approaches, strategies can differ dramatically. Some funds look a lot like their starting universes, while others venture further from their starting points to offer strong exposure to ESG leaders. For example, MSCI Universal and MSCI SRI index strategies both use the same MSCI ESG scoring system, but the former heavily reweights a lightly screened parent index, while the latter selects only the top quartile of ESG scorers using market weights.

- Securities Selection and Weighting. It is important to understand the extent to which the fund is pursuing firms with strong ESG characteristics. A fund’s securities selection and weighting approach has a big impact on the type of ESG exposure it delivers.

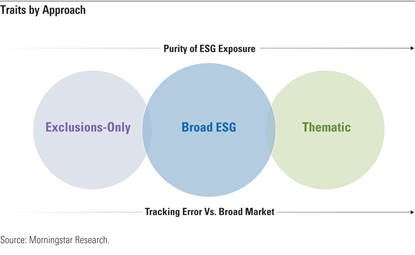

- Tracking Error. Tracking error and active share (a measure of the percentage of stock holdings in a fund's portfolio that differs from the benchmark index) both measure the level of active risk each fund takes versus its parent index. These are useful metrics for gauging how intensely a fund pursues ESG leaders and whether it might be appropriate as a core holding. There is trade-off between high ESG exposure on one hand, and broad diversification and low tracking error on the other. For example, those investors most committed to sustainability may favor the "purest" ESG exposure at the expense of a more-concentrated portfolio with higher tracking error. Investors seeking to replace a core portfolio allocation may be more willing to compromise on "purity" of ESG holdings (for example, accept less-compliant holdings) in exchange for retaining the benefits of diversification and lower tracking error.

Factors that affect tracking error include security-selection methodology, exclusions, and weighting schemes. Optimization techniques can be used to minimize tracking error. For example, the optimized MSCI ESG Focus and MSCI Low Carbon Target indexes aim for tracking error targets of 0.5% and 0.3%, respectively, for developed markets.

Persistent sector and geographic biases come from the fact that ESG scores tend to vary across geographies and sectors. For example, European companies tend to score well on many sustainability metrics, while emerging markets tend to score poorly. Some sectors, such as oil and gas, are prone to low overall ESG scores, while others, such as technology, may have higher ESG scores owing to the nature of the underlying businesses. Sector and geographic biases can affect performance relative to the broader market, even in the long run.

Key Considerations When Choosing a Passive Sustainable Fund: Fund Level Analysis

The way in which a fund tracks its index also has sustainable implications.

- Fees. These are always a key consideration when analyzing funds. Sustainable passive funds tend to charge more than their nonsustainable peers. Some fee premiums can be expected, as there are undoubtedly costs associated with gathering robust ESG data and building a suitable sustainable investment strategy. That said, large fee differences between outwardly similar funds need to be justified.

- Securities Lending. This practice sees the fund lend out a portion of its holdings for a small fee. As part of the transaction, the fund receives a collateral basket. As above, if the type of collateral accepted is not restricted, the fund could end up holding non-ESG-compliant investments.

- Asset Manager. Active ownership, which includes proxy voting and engagement, is a key consideration at the fund group level. These efforts can involve voting on shareholder resolutions and opening dialogues with portfolio companies on ESG issues to enact change. Leaders in the space have detailed environmental and social proxy voting guidelines; a track record of putting forward ESG shareholder proposals and/or voting in favor of these types of resolutions; an outcome-oriented engagement strategy with a clear escalation strategy; and have disclosed voting records, rationales behind key votes, and engagement activities.